Morningstar

請至文末下載 PDF 檔,閱讀完整報告內容。

Executive Summary

In a nutshell, we expect a win by former Vice President Joe Biden over President Donald Trump to be taken positively by the Asian stock markets. This is because we think a Biden win likely signals a return to a multilateral approach in U.S. foreign policy. We think the Trump trade tariffs will be reexamined and most likely lead to removals after some negotiations. The potential removal of the Section 301 tariffs should have a positive indirect impact. However, there are still significant strategic differences between the U.S. and China, and this is likely to mean continued targeted trade restrictions in certain sectors and a higher potential threat of global sanctions against China. Also, the main driver to near term earnings remains the containment of the pandemic. Our base case view remains for a COVID-19 vaccine to be available by mid-2021 that will allow economic activity to start normalizing from then on. We have not factored in potential positives from reduced tariffs.

Key Takeaways

× We think a key difference between Biden and Trump to be the approach to trade. We expect Biden would be willing to negotiate and remove much of the Trump tariffs, starting with U.S. allies. While multilateral trade agreements would not be the immediate priority, we think they will be considered if they help restore U.S. relationships and leadership.

× However, we think bans on trade with certain Chinese companies and in certain sectors may continue.

This could continue to present a risk for select Chinese names that are dependent on U.S. advanced technology.

× Even with bipartisan dislike of Chinese policies, we think there is limited support for the bans on TikTok and WeChat as seen by the federal court injunctions against them. We suspect that Biden may cancel the executive orders issued to ban use of TikTok and WeChat by Americans.

× Within our coverage we think Samsonite will see material direct benefit from a reduction in U.S. tariffs.

While we think Samsonite could pass on the cost savings eventually, it should still provide a near term boost to gross margins.

× Our coverage universe indicates that Asian stocks are slightly undervalued currently by around 7%.

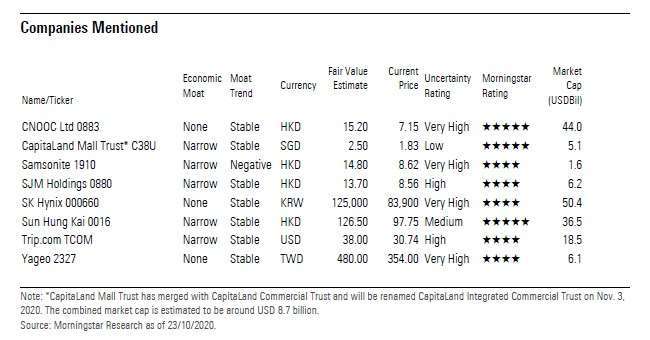

While we don"t see any grossly overvalued sectors, there is a significant valuation gap between the real estate and energy sectors and the technology and consumer cyclical sectors. In this regard, we favor stocks such as CNOOC Ltd, Sun Hung Kai, and CapitaLand Mall Trust. We like stocks with exposure to China consumption such as Trip.com and SJM Holdings. We remain selective on the technology sector we prefer SK Hynix and Yageo, both of which should benefit from a pickup in 5G infrastructure spending.

上一篇

下一篇