Equity Index market briefing April 2023

Zubin Ramdarshan, Head of Equity & Index Product Design, Eurex 2023-04-27 09:19

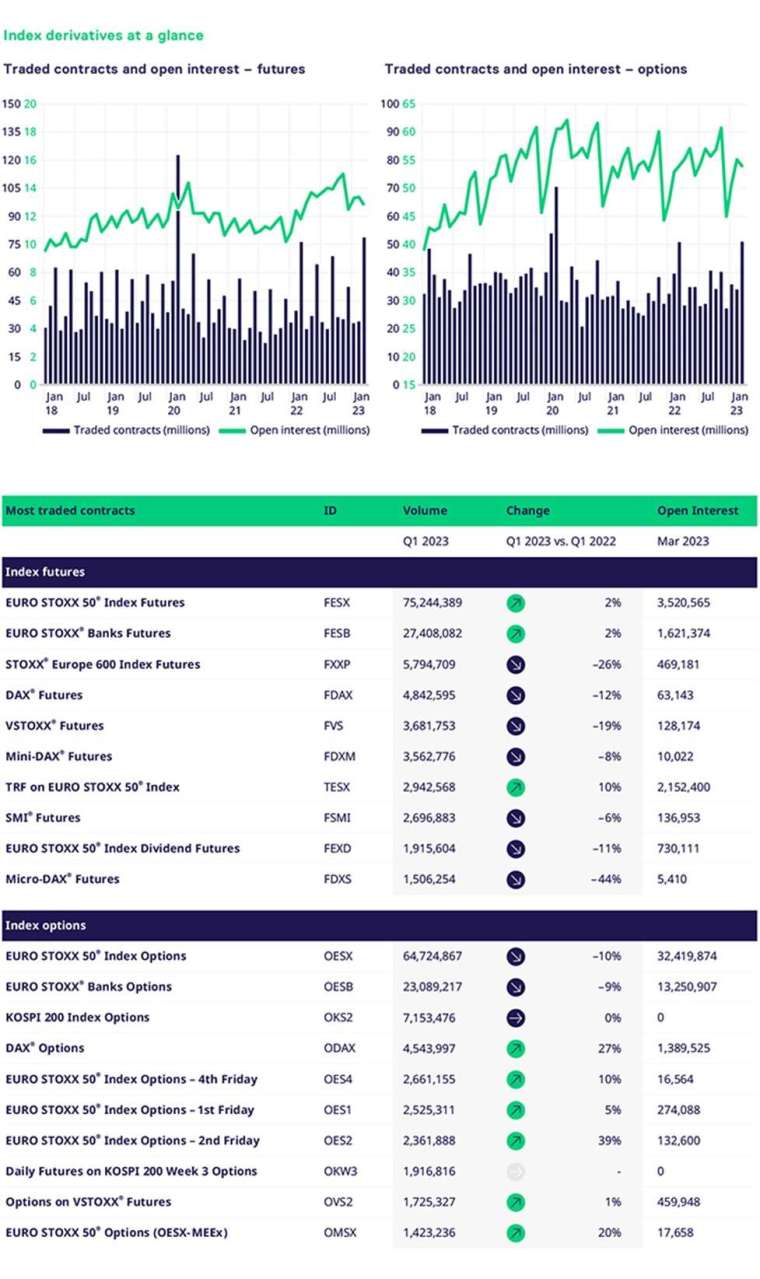

Compared to last year"s busy period, volume growth was seen across several benchmark index derivatives

Q1 was an unexpected rollercoaster of market volatility. The strong equity rally in January, driven by bullish expectations of China reopening, was aggressively retraced in February for US benchmarks. It took until March for European markets to react negatively. By the end of the quarter, most global broad-based benchmarks were back into YTD gains, quite some surprise given the news flow. The core catalyst remains interest rate levels and expectations. The run on several mid-sized US banks and the forced merger of UBS and Credit Suisse suggest that equity markets are shrugging off any negative sentiment. In contrast, rates and fixed income markets show early signs of distress. At last month"s Frankfurt Derivatives Forum, several portfolio managers pointed to the historically wide gap between rate vs. equity volatility as a concerning development.

Naturally, his sustained bout of volatility brought a corresponding jump in hedging demand for Eurex derivatives. Compared to last year"s busy period, volume growth was seen across our benchmark index futures and options on EURO STOXX 50®, DAX, KOSPI, STOXX® 600 and VSTOXX®. The Total Return Futures segment also saw a leap in volumes. Unsurprisingly, the Banks sector TRF was in focus, a similar picture for the Banks dividend futures and options. The global gyrations triggered some large rebalancing across MSCI index positions, with the highest volumes for EM Asia, China, EM EMEA, EM, Europe, Canada and Saudi Arabia.

Regarding new product launches, Eurex announced the introduction of the new FTSE Bitcoin Index futures, with two versions denominated in EUR and USD, set to launch next month. The futures are supported by a robust index methodology and backed by Digital Asset Research"s expertise. We expect a good level of interest during both the Asian and European / US trading hours.

Members also successfully navigated the NextGenETD project roll-out, which paves the way for the much-anticipated introduction of intraweek daily expiring index options towards the end of Q2.

- 掌握全球財經資訊點我下載APP

上一篇

下一篇